It’s going up. Then it’s coming down. It’s going up again. And then coming back down again. Well, hold on to your seat folks. It’s going to be in a wild ride in the stock market for the near future. I wish that I can provide you with a prediction on the direction the market is heading, but I don’t have a crystal ball.

While there are lots of volatility in the stock market, just remember one thing, the market fluctuation is normal. Don’t panic and liquidate your investments. Remain calm, stay invested and keep in mind that in the long run, the market is on an upward trajectory. Use this volatility as an opportunity to invest in sectors that had been beaten down or re-balance your portfolio.

Last quarter, I mentioned that my streak of net worth increases ended. Well, for this quarter, the short negative trend had been reversed and I am starting a new positive streak once again. Not only did I recovered all my loses in the first quarter, I actually broke into new territories and achieved new financial milestones. I am excited to share my seventh quarterly net worth review with you. I hope that you will enjoy reading as much as I enjoyed reviewing them.

What’s Covered In My Net Worth Review

If you have not started your personal net worth review for 2018 yet, I hope that this post will inspire you to get started. As usual, I’ll reflect on the following areas: net worth, real estate, debts, savings, and investments. Regardless of whether my net worth increased or decreased for the quarter, I will try to provide as much commentary as I can regarding the performance of each financial category.

Why I Am Sharing My Net Worth Review

For new readers, the reason that I share my personal net worth review every quarter is to make myself accountable for my financial decisions. I want to encourage all my readers to take control of their personal finance and manage their money responsibly. I believe in transparency, accountability and knowledge sharing. If anyone has any questions, I encourage and welcome any inquiries in the comment section and I will try my best to address them.

What’s not my intent is to show off how much money I have or how great I am at managing my money. Please understand that everyone’s financial knowledge, motivation, risk tolerance and life situation is different. The actions that I had taken to improve my finances may or may not be suitable for everyone. The takeaway from my experience is to do whatever that makes sense to your personal situation not because someone else is doing it. So, without further ado, let’s get to the nitty-gritty details.

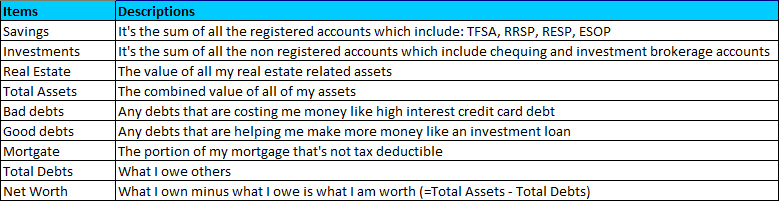

Table #1: The descriptions of items in my net worth review.

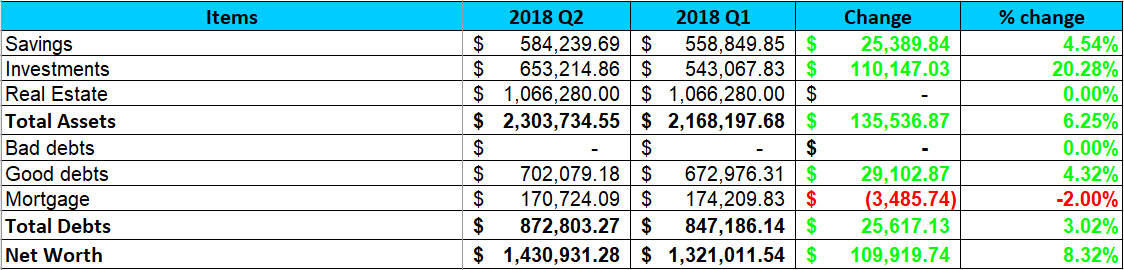

Table #2: 2018 – Q2 Personal Net Worth Performance

Net Worth Review

Last quarter, I mentioned that whenever the stock market retracts, I would find ways to buy more stocks. That was exactly what I did during the last couple of months – I bought more stocks. As the stock market recovered all of the losses during the first quarter of the year, my portfolio recovered alongside the stock market. This recovery was thoroughly felt in my net worth as it increased more than $109K (See Table #2), making it one of the best performing quarters I’ve ever had.

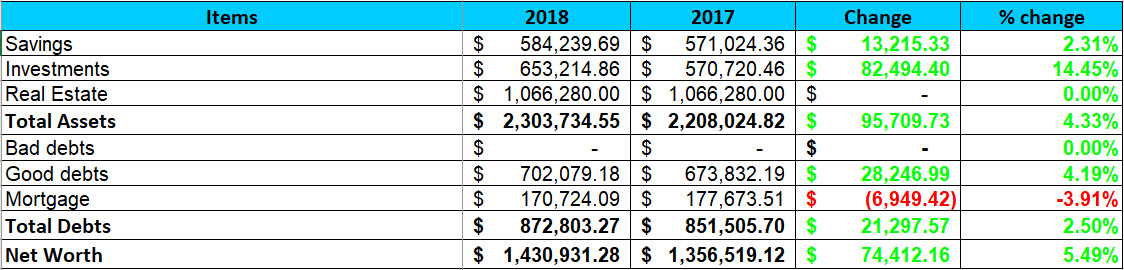

When my net worth decreased by $35K last quarter, I thought that it would be very difficult for me to be on track to increase my net worth by 10% this year. Surprisingly, with a great second quarter, not only did I recovered all the losses, my net worth increase got back on track. I was actually a little ahead of the pace of 5% increase with a 5.49% year-to-date net worth increase for the first half of the year (See Table #3).

Table #3: 2018 – Q2 YTD Personal Net Worth Performance

If my net worth ended this year at the current numbers, I would be content with the small increase considering all the volatility in the stock market. In addition, my current net worth level of $1.43M represents the first time that it broke through the $1.4M mark. It definitely feels great to be able to reach this financial milestone. As a result, this category deserves an “Exceed Expectation” rating.

Real Estate Review

The Canadian Real Estate market continues to cool for the low rise market. However, the condo market is quite resilient and continues to grow even with headwinds such as stricter mortgage rules and rising interest rates. If you have been paying attention to the real estate section of my net worth, you’ll notice that it hadn’t changed since 2016. I am happy to keep the value at the current level as the value doesn’t affect my day to day finance.

Based on my research, the combined value of my real estate holding is actually closer to the $1.28M range rather than the current estimate of $1.066M. The reason that I did not want to update my estimate is that I want to leave some room for error if I have to liquidate my properties quick. It’s better to underestimate and be surprised by comparing to overestimating and be disappointed if you do not get the value that you need when you sell.

Recently, we received a letter from our builder indicating that our condo unit in downtown Toronto will be ready soon. I am really excited that there is progress being made and I will have a chance to explore the hot downtown condo rental market. This will add another source of income to help increase my monthly cash flow. As usual, with the lack of activity on this front, I am rating this category with a marginal “Meet Expectation” rating.

Debt Review

Oops! I did it again. I borrowed more money to invest. If you noticed that the good debt section in Table #3 above increased by about $28K, that was due to another personal investment loan that I took out. Last quarter, I had the opportunity to borrow another $30K at a fixed rate of 3.5% per year, so I took advantage of it. I used the loan proceeds to add to my investment positions for the stocks that dropped earlier this year.

As the prospect of rising interest rate is imminent, I am looking to maintain my current cost of borrowing as much as I can or start reducing my debt if my investment interest cost is getting higher than 5% per year. I still strongly believe that I can earn a decent return if my cost is 5% or below. If the interest cost starts to rise above 5%, I will start to deleverage and pay back my investment loans.

In my view, if I am earning a 7% or 8% return on my investment and it cost me let say 6%, then I am just taking too much risk just to earn that 1% or 2% after factoring in the investment cost. I’d rather wait for better opportunities or not borrow at all. Since my investment cost is still below 4% overall, I am content to continue on my borrow to invest path. With such a prudent debt management view, this category deserves a prudent “Meet Expectation” rating.

Savings Review

My financial goals at the start of every year are pretty much the same old boring goals. My first priority is to maximize the RESP contribution for both of my kids. Why do I do this? I have an evil plan. If I provide them with the opportunity to obtain a higher level of education, then there’s a higher chance that they will make enough money to support themselves. I’ll never have to support them again after their post-secondary education. Great plan huh?

My second priority is to maximize my family’s RRSP contribution limit every year as it provides us with a great tax refund. If I am able to save for my retirement and pay less income tax, I am in. What I really like about the RRSP is that every dollar that I contribute, it reduces my income tax at the highest tax bracket. I am getting $0.43 back for every $1.00 that I contributed to my RRSP. Gotta love it.

The third priority is to maximize our TFSA contribution limits. This year, I am falling behind a little bit as I often have this goal achieved by January. However, this year, I was waiting for my tax refund to maximize my TFSA instead of having the money saved the previous year. In addition, I procrastinated with my tax filing so my tax refund is a bit late. I should be able to maximize my TFSA contribution by the next quarter.

The last item is our Vacation Fund. We just took a family cruise in early April and a couple of short trips recently. All those trips had been paid for. Hence, I am not in a hurry to top up this fund as we don’t have any plan for the next vacation yet.

| Items | Target | Amount Saved | Progress |

|---|---|---|---|

| RESP | $5,000.00 | $5,000.00 | 100.00% |

| RRSP | $14,000.00 | $5,000.00 | 35.71% |

| TFSA | $11,000.00 | $0.00 | 0.00% |

| Vacation Fund | $10,000.00 | $0.00 | 0.00% |

| Total Savings | $40,000.00 | $10,000.00 | 25.00% |

Table #4: My family saving goals for 2018

From the table above, only one out of four of our family saving goals was completed by the end of the second quarter. At this pace, we are a bit behind on our savings rates.

Normally, my preference is to have my savings contribute about 1/3 and my investments contribute about 2/3 of the increase in my net worth. As time goes by, I’d like my investments to account for the lion’s share of the increase in my net worth. This is exactly what happened during the last quarter as the market performed very well and my investment did most of the heavy lifting. As a result, this category deserves a “Need Improvement” rating as my saving rate is at 25% instead of 50% of my annual goal.

Investments Review

Finally, we reached the investment section. I purposely leave this category last because I enjoy reviewing this category the most. If you have been reading my blog, you’ll notice that I have one very important money philosophy. “It’s not how much you earn, it’s how much you get to keep after taxes.” Every year, my goal is to pay the least amount of income tax as I possibly can, legally of course. So for this category, I will further break the review into sections: capital gains, dividends, interest costs and re-balancing, to discuss my strategies to keep more money in my pocket.

Capital Gains

For regular iSaved5K readers, you’ll notice that I had been selling options contracts from time to time. Below is the list of covered call and naked put contracts that I sold before the Q2 of 2018. For the covered called contracts, regardless of the current performance of the contracts, I will make money from those trades one way for the other. If the contract does not get executed, I will keep the premium for free. If it’s executed, I will make at least at 15% gain (premium + dividend + capital gain) on the stock for the current year. If you need a refresher to get up to speed on how I make money with options, check out this options basics post.

| Options – Contracts | Ticker | Expiry Date | Strike Price | Premium | Status | Return |

|---|---|---|---|---|---|---|

| Covered Call – 2 | CMG | January 18, 2019 | $480.00 | $1,488.00 | Active | -325.40% |

| Covered Call – 7 | EXR | September 20, 2018 | $85.00 | $3,500.00 | Active | -565.83% |

| Covered Call – 7 | SLF | January 18, 2019 | $58.00 | $693.00 | Active | +44.44% |

| Covered Call – 5 | TCK.B | January 18, 2019 | $43.60 | $1.985.00 | Active | +85.39% |

| Naked Put – 4 | BCE | January 18, 2019 | $56.00 | $780.00 | Active | -66.67% |

| Naked Put – 3 | CNR | January 18, 2019 | $90.00 | $990.00 | Active | +60.96% |

| Naked Put – 5 | FTS | January 18, 2019 | $42.00 | $790.00 | Active | -0.63% |

| Naked Put – 1 | GOOG | January 18, 2019 | $600.00 | $789.00 | Active | +51.00% |

| Naked Put – 1 | GOOG | January 18, 2019 | $850.00 | $5,300.00 | Active | +68.90% |

| Naked Put – 5 | V | January 18, 2019 | $70.00 | $610.00 | Active | +85.29% |

| Naked Put – 3 | V | January 18, 2019 | $90.00 | $1,155.00 | Active | +85.02% |

Table #4: Existing Active Options contracts sold before Q2 of 2018.

With the market being quite volatile the last couple of months, I took advantage of it and timed the market with my options trades. I sold a few covered call options for the stock that I owned and naked put options for the stocks that I don’t own but want to own in the future. The table below is the list of options contracts that are still active in my account. Let’s hope that most of them will expire so I can keep the premiums for free.

| Options – Contracts | Ticker | Expiry Date | Strike Price | Premium | Status | Return |

|---|---|---|---|---|---|---|

| Covered Call – 13 | BB | January 18, 2019 | $15.00 | $715.00 | Active | +67.27% |

| Covered Call – 2 | CNR | January 18, 2019 | $120.00 | $240.00 | Active | +12.50% |

| Covered Call – 8 | PKX | November 16, 2018 | $95.00 | $3,580.00 | Active | +62.01% |

| Covered Call – 4 | SNC | December 21 18, 2018 | $62.00 | $540.00 | Active | -29.63% |

| Naked Put – 5 | BNS | January 18, 2019 | $70.00 | $990.00 | Active | +5.05% |

| Naked Put – 6 | DOL | January 18, 2019 | $46.67 | $1,078 | Active | -33.58% |

| Naked Put – 3 | JNJ | January 18, 2019 | $115.00 | $963.00 | Active | +20.56% |

Table #5: New Options contracts sold during Q2 of 2018.

There are a few reasons that I love to time the market with options contracts. First, it’s a great source of passive income and cash flow. Second, only half of the gain is being taxed because the options income is a form of capital gain. Third, when there’s volatility, you’ll be able to collect more premium for the options contracts as it’s one of the factors that affect the price of options.

Dividends

Not all dividends collected are equal in terms of income tax treatment. Only dividends earned from Canadian eligible companies get the preferential tax treatment. The dividend is taxed at a lower tax rate comparing to normal income. This is the reason why my non-Registered investment account is made up of mostly Canadian dividend-paying stocks. For non-Canadian dividends, it’s treated as normal income so it’s not tax efficient.

There is no maneuver to lower your dividend income. However, you do get a dividend tax credit for Canadian eligible dividends. The amount of credit you get is determined by the amount of (Canadian eligible) dividends that you earned during the year. For me, the total amount of dividends that I collected in my non-Registered investment account for the first six months is about $14,000. I can see this year’s tax bill inflating pretty quickly already.

One of the benefits of getting these dividends on a regular basis is the added cash flow. I can comfortably pay for my investment loans on a monthly basis without any added stress to my budget. Simply put, my investments are paying for itself.

Interest Costs

With interest rates rising, my investment cost is also rising too for a portion of my investment loans. Luckily, I still have the majority of my loans locked up under 3.5% per year. I will have to take a closer look at my borrowing to invest strategy every time the interest rate increases. To give you some perspective, when you borrow $700K, a 0.25% increase in interest rate cost you about $1,750/year. This number can add up pretty quickly if the interest rate increases a few times.

Since I am able to deduct the interest cost and I am able to get $0.43 for every dollar in interest cost, I am not too worried yet. I can still comfortably cover my loan payments with all my incomes. If I can lock in my loan for under 4% for my next loan renewal, I’ll definitely be happy with it.

Rebalancing

When you buy a basket of stocks, there’s a very high chance that you will have a loser or two in your picks. Even the best stock pickers still have losers in their portfolio so don’t feel bad if you have a couple of losers in yours. I also have a few losers too. It sucks when that happened, but it’s unavoidable. Just minimize the number of losers and play the percentage game. If your stock picking success rate is 65% or above, you’re in great shape.

Though I did not sell any stock the last quarter, I was adding to my positions as I used the new $30K investment loan to buy more stocks. As it turned out, the timing was great and I was able to buy some stocks on the dip. Hence, there are this is another way to re-balance your portfolio. You don’t have to sell any stocks to re-balance.

With a great recovery in the stock market during the second quarter, my investment accounted for the majority of the gains in my net worth. As a result, this category deserves an excellent “Exceed Expectation” rating.

2018 – Q2 Overall Performance

Overall, this quarter has been a great quarter from an investment and net worth growth perspective. Anytime when my net worth increases by more than $100K per quarter, I gotta be happy with that. Not only did I recovered from the losses in the first quarter, the gain for this quarter put me back on track to reach my annual net worth goal. I will get to that shortly.

Every year, my investment goal is to beat both the Candian’s S & P TSX Index and the U.S.’s S & P 500 index. Right now, it’s too early to tell, however, with a year-to-date net worth increase of 5.49%, I think that I have a good chance to beat the two indices.

All in all, there is only one number that really matters to me – my personal net worth. Regardless of what happened in each of the categories, the bar is set at 10% net worth increase. If my net worth increased above this number, then I’ve exceeded my own expectation. Anything less than 10% is not meeting my expectation. At this rate (5,49%), I am back on track for the first half of the year. As a result, this quarter’s performance deserves an “Exceed Expectation” rating.

So readers, how often do you conduct your personal net worth calculation? What financial goals did you set for yourself in 2018? How do you balance your current lifestyle with saving for the future?

About Leo

About Leo

Glad to learn about personal net worth here and seriously need to think of doing one myself. Thanks for sharing your personal net worth here as it has all the figures so making it very easy to understand.

Well…since you asked. I have been tracking my net worth for 20 years and update weekly. I am hoping for 17% increase this year and next, then 10% the next 7 years until retirement at 50. If I fall short will need to work longer. I only buy canadian dividend stocks. Mostly in registered accounts so minimal tax. Conservative growth oriented. See ya on the beach!

Leo you are on fire!!!!! That’s fantastic, great job keep up the great work!!

$100K in a quarter!!

man that is a great quarter!

congrats on a solid increase over the quarter.

keep it up Leo

cheers

good job!! I am only starting, but your blog will help me in growing and tracking my net worth.

You are doing awesome! I need to check and see what my net worth is. I’m curious now.

Wow – congratulations on doing so well in your finances! Keep up the good work. Looking forward to your next update.

I never thought to look at my net worth. Right now I am focusing on saving to pay off the house.

What I love about this is that you are aware of your finances, It will help you plan for the future.

I’m not well versed in the financial aspects. Let’s just say it doesn’t interest me but I know how much proper planning is needed for a good life and also for a good retirement life.

Congratualations. Your hard work has helped you reach where you are today. I am sure that many will find your work inspiring.

Very informative article. Made me rethink a few things about my own investments.

This is so informative. I do track my finances and take time for a review every month. You are doing very well for yourself, thanks for the inspiration.

This was incredibly thorough and well put together. I had never even considered a personal net worth review before, and now I’m eager to try my own.

First off, congrats! Second, thanks for explaining so thoroughly and explaining how to do the same.

Wow. This is amazing! I haven’t started focusing on my finances yet but I am interested to try.

This was so detailed and interesting. I think I need to start doing a review like this once a year as well so I can keep track of my progress.

I would never be brave enough to play the stock market as it seems to much like a big casino to me. But obviously you are having great success so I wish you continued good fortune.

wow this was so well explained and congrats on your progress thats amazing

Thank you for your comment! I am terrible with numbers and that is why I have a financial planner to help me out with everything! It’s very important to calculate our personal net worth. A lot of times I stress about money, but when I put everything down on paper, my life gets so much better. We can lose track very quickly.

This is a very informative post. Thank you!!

It is really interesting reading about net worth, I am fortunate to have company stock and earned a bit of a fortune for myself.