Boy, am I glad that the first quarter of 2018 is now in the books. The first month of the year started out quite well. I thought that I was on my way to a sixth consecutive quarter of net worth gains. As the calendar turns to February, the stock market has other ideas and wiped out all of my gains for January and more. Hence, my net worth gain streak ended at five quarters. Well, one streak ended, a new one will start.

What’s Covered In My Personal Net Worth Review

If you have not started your personal net worth review for 2018 yet, I hope that this post will inspire you to get started. As usual, I’ll reflect on the following areas: net worth, real estate, debts, savings, and investments. Regardless of whether my net worth increased or decreased for the quarter, I will try to provide as much commentary as I can regarding the performance of each financial category.

Why I Am Sharing My Personal Net Worth Review

For new readers, the reason that I share my personal net worth review every quarter is to make myself accountable for my financial decisions. I want to encourage all my readers to take control of their personal finance and manage their money responsibly. I believe in transparency, accountability and knowledge sharing. If anyone has any questions, I encourage and welcome any inquiries in the comment section and I will try my best to address them.

What’s not my intent is to show off how much money I have or how great I am at managing my money. Please understand that everyone’s financial knowledge, motivation, risk tolerance and life situation is different. The actions that I had taken to improve my finances may or may not be suitable for everyone. The takeaway from my experience is to do whatever that makes sense to your personal situation not because someone else is doing it. So, without further ado, let’s get this personal net worth review started.

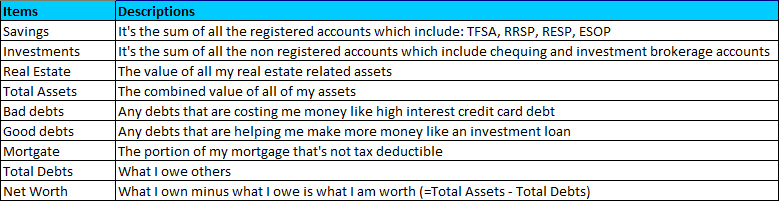

Table #1: The descriptions of items in my personal net worth review.

Table #2: 2018 – Q1 Personal Net Worth Performance

Personal Net Worth Review

This quarter has been a very volatile quarter and fear started to affect people’s investment decisions. Some pundits are calling for a recession in the U.S. as the last one was about nine years ago and way overdue. While others are predicting a massive selloff as the stock market is way overpriced.

For me, I am never afraid of market downturns. In fact, if there is one in the near future, I’ll be finding ways to buy more stocks as I see a discount sign from the market instead of the sky is falling sign. Just remember, nothing goes up or down in a straight line over time. Hence, if you have money sitting around, the best time to put it to work is when there is a lot of chaos and confusion in the market.

With all the chaos in the stock market, my investment and net worth suffered some setbacks. I ended the quarter with a decrease of (2.62%) in my personal net worth (see table #2). This decrease equates to more than $35K, but it’s actually just around $25K as I used up my allocated vacation funds ($10K) to pay for an upcoming family vacation.

This decrease is just a little bump in my financial journey and I had a few of those before. So it’s no big deal. Still, a bad quarter is a bad quarter. This category is getting a “Not Meeting Expectation” rating. Hopefully, I can improve it in the next quarter.

Real Estate Review

The Canadian Real Estate market is starting to cool off a bit. Is this a soft landing or the housing bubble is starting to burst? This seems to be the two most discussed topics when it comes to the Candian Real Estate market. Even my mom was interested and she asked me what’s my view of the real estate market.

I told her that my guess is just as good as hers as I can’t predict which direction the market will go nor can I predict how far the average price will drop. What I did observe was the sales volume and average price around the Greater Toronto Area (GTA) is decreasing overall. To put it in perspective, the lowrise market is really slow and has pretty much turned into a buyer’s market. However, the highrise market is still very much a seller’s market as it’s still experiencing a year over year price increases due to the limited listings.

For myself, I am quite content with my real estate holding for now. I have my principal residence, a rental property that I operate with my friend and a pre-construction condo unit that will be ready in about two years. With interest rates on the rise and a stricter mortgage qualifying requirement, staying put is a prudent option. Hence, this category is getting a “Meet Expectation” rating.

Debt Review

I did the absolute minimum with my debts for most of 2017. I was content to make only the required monthly payments for my mortgage and investment loan until I had to pay off $35K of debt in an afternoon during last December. However, for 2018, with rising interest rates, I am starting to take a closer look at my investment loan costs. As interest rates rise, my investment costs rise along too, which makes my borrow to invest strategy more expensive and risky.

As of now, most of my investment loans are still locked in for another two more years, except for my margin account interest. If interest rates continue to rise, I will start to reduce my debts starting with the highest interest cost first. I will only borrow if I think that I can confidently profit from an investment after paying the interest cost. There is no point in taking that much risk when I am investing just to pay off the loan.

One thing that I would like to remind my readers is to borrow responsibly. Don’t borrow too much and put your finance at risk. There will always be more opportunities down the road even if you missed one or two right now. I will be following this boring philosophy as it’s working for me. With such a prudent debt management view, this category deserves a prudent “Meet Expectation” rating.

Savings Review

My financial goals at the start of every year are pretty much the same old boring goals. My first priority is to maximize the RESP contribution for both of my kids. Why do I do this? I have an evil plan. If I provide them with the opportunity to obtain a higher level of education, there’s a higher chance that they will make enough money to support themselves. I’ll never have to support them again after their post-secondary education. Great plan huh?

My second priority is to maximize my family’s RRSP contribution limit every year as it provides us with a great tax refund. If I am able to save for my retirement and pay less income tax, I am in. What I really like about the RRSP is that every dollar that I contribute, it reduces my income tax at the highest tax bracket. I am getting $0.43 back for every $1.00 that I contributed to my RRSP. Gotta love it.

The third priority is to maximize our TFSA contribution limits. This year will be a bit challenging as we used up our bonuses at the end of last year to pay off some debt. Originally, that money was earmarked for our TFSA, but life events happened and we had to change our saving plans. To maximize our TFSA, I had to be a bit more creative and work harder this year.

Last, but not least, I need to prioritize living now versus saving for the future. At this point in my life, I feel that there’s a bit of wiggle room for me to allocate some money to buy quality experiences and memories for my family. A portion of my $17K tax refund will be allocated to this priority.

| Saving Category | Target | Amount Saved | Progress |

|---|---|---|---|

| RESP | $5,000.00 | $5,000.00 | 100.00% |

| RRSP | $14,000.00 | $2,000.00 | 14.29% |

| TFSA | $11,000.00 | $0.00 | 0.00% |

| Vacation Fund | $10,000.00 | $0.00 | 0.00% |

| Total Savings | $40,000.00 | $7,000.00 | 17.50% |

Table #3: My family saving goals for 2018

From the table above, only one out of four of our family saving goals was completed by the end of the first quarter. At this pace, we are a bit behind on our savings rate. I am not too worried about it yet as last year’s tax refund will allow me to maximize the TFSA limit by the second quarter. I will also try to top up my vacation fund at the same time. This leaves me with only the RRSP saving to work on for the rest of the year. Since this is only a plan, I can’t take the credit for this category yet. As a result, this category is still getting a “Need Improvement” rating as I am currently behind.

Investments Review

Finally, we reached the investment section. I purposely leave this category last because I enjoy reviewing this category the most. If you have been reading my blog, you’ll notice that I have one very important money philosophy. “It’s not how much you earn, it’s how much you get to keep after taxes.” Every year, my goal is to pay the least amount of income tax as I possibly can, legally of course. So for this category, I will further break the review into sections: capital gains, dividends, interest costs and re-balancing, to discuss my strategies to keep more money in my pocket.

| Options – Contracts | Ticker | Expiry Date | Strike Price | Premium | Status | Return |

|---|---|---|---|---|---|---|

| Covered Call – 5 | WFC | January 19, 2018 | $65.00 | $963.77 | Expired | +100.00% |

| Naked Put – 3 | BMO | January 19, 2018 | $88.00 | $961.30 | Expired | +100.00% |

| Naked Put – 2 | GS | January 19, 2018 | $185.00 | $1,367.51 | Expired | +100.00% |

| Naked Put – 5 | KO | January 19,2018 | $38.00 | $1,150.00 | Expired | +100.00% |

| Naked Put – 3 | WMT | January 19,2018 | $65.00 | $1,335.00 | Expired | +100.00% |

| Covered Call – 5 | WFC | January 18, 2019 | $75.00 | $860.00 | Cancelled | +92.00% |

Table #4: Expired/Cancelled Options contracts.

Capital Gains

If you’re a regular iSaved5K reader, you’ll know that I had been selling options contracts from time to time. All the expired/cancelled contracts listed in the table above had worked out in my favour. I get to keep all the premiums for free and the incomes are taxed as capital gains. If you need a refresher to get up to speed on how I make money with options, check out this options basics post.

| Options – Contracts | Ticker | Expiry Date | Strike Price | Premium | Status | Return |

|---|---|---|---|---|---|---|

| Covered Call – 2 | CAT | January 19, 2018 | $110.00 | $628.00 | Exercised | 0.00% |

| Covered Call – 4 | MCD | January 19, 2018 | $140.00 | $765.03 | Exercised | 0.00% |

| Naked Put – 1 | CMG | January 19, 2018 | $360.00 | $2,489.00 | Exercised | 0.00% |

| Naked Put – 5 | ENB | January 19, 2018 | $50.00 | $933.80 | Exercised | 0.00% |

Table #5: Exercised Options contracts sold during 2017.

For the covered call contracts in the table above, I had to sell my stocks at the strike price, which was lower than the current market price. I was satisfied with those trades as I had set the strike price high enough for me to make a decent return. Once again, those gains will be taxed as capital gains.

As for the naked put contracts, I had to buy the stocks at a higher price than the current market price. Sometimes you win, and sometimes you lose when you write these options. I lost a bit of money on those trades. At the time that I wrote those options, I would have been happy to buy those stocks at the strike price. When I take the premium into account, I actually bought it cheaper than the strike price. Hence, I was content to own those stocks at a price lower than the strike price.

| Options – Contracts | Ticker | Expiry Date | Strike Price | Premium | Status | Return |

|---|---|---|---|---|---|---|

| Covered Call – 2 | CMG | January 18, 2019 | $480.00 | $1,488.00 | Active | +5.91% |

| Covered Call – 7 | EXR | September 20, 2018 | $85.00 | $3,500.00 | Active | -0.54% |

| Covered Call – 7 | SLF | January 18, 2019 | $58.00 | $693.00 | Active | +17.17% |

| Covered Call – 5 | TCK.B | January 18, 2019 | $43.60 | $1.985.00 | Active | +70.28% |

| Naked Put – 4 | BCE | January 18, 2019 | $56.00 | $780.00 | Active | -71.79% |

| Naked Put – 3 | CNR | January 18, 2019 | $90.00 | $990.00 | Active | -27.52% |

| Naked Put – 5 | FTS | January 18, 2019 | $42.00 | $790.00 | Active | -20.83% |

| Naked Put – 1 | GOOG | January 18, 2019 | $600.00 | $789.00 | Active | +31.41% |

| Naked Put – 1 | GOOG | January 18, 2019 | $850.00 | $5,300.00 | Active | +50.14% |

| Naked Put – 5 | V | January 18, 2019 | $70.00 | $610.00 | Active | +36.00% |

| Naked Put – 3 | V | January 18, 2019 | $90.00 | $1,155.00 | Active | +46.11% |

Table #6: Active Options contracts sold during 2017 and 2018.

With the market being quite volatile the last two months, I took advantage of it and timed my options trades. I sold a few covered call options for the stock that I owned and naked put options for the stocks that I don’t own but want to own in the future. The table above is the list of options contracts that are still active in my account. Let’s hope that most of them will expire so I can keep the premiums for free.

Dividends

One of the benefits of getting dividends on a regular basis is the added cash flow. I can comfortably pay for my investment loans on a monthly basis without any added stress to my budget. Simply put, my investments are paying for itself.

The added bonus is that some of the stocks that I own raised their dividends. As a result, I am being rewarded for doing nothing. I am hoping to grow my dividend income to about $80K to $100K per year in 6 to 8 years time. If I reached that goal, I will be able to buy my freedom and have the option to choose if I want to work or not.

Interest Costs

Since I borrow about $673,000 at 2.59% per annum, my interest cost is about $17,430 (=$673,000 * 0.0259) per year. On top of that, I also invest in a margin account for my U.S. stocks and the interest can add up to about $10,000 Canadian per year. Hence, I get to deduct about $27,430 from my income at the highest tax bracket. If I can lower my capital gain to about $0, then I will get a huge tax refund (my highest combined tax rate is 43%). The trick I use is in the next section.

Rebalancing

When you buy a basket of stocks, there’s a very high chance that you will have a loser or two in your picks. Even the best stock pickers still have losers in their portfolio so don’t feel bad if you have a couple of losers in yours. I also have a few losers too. It sucks when that happened, but it’s unavoidable. Just minimize the number of losers and play the percentage game. If your stock picking success rate is 65% or above, you’re in great shape.

Ideally, I’d like to have zero losses and would be happy to pay my fair share of income taxes. Unfortunately, I am not perfect and made quite a few mistakes. Hopefully, I will make fewer mistakes and be able to balance my portfolio better in the future.

I normally re-balance my portfolio when I see fit. It doesn’t mean that I have to buy and sell all the time. Sometimes when I have new money, I just buy the sectors that are underrepresented. This is one way that I rebalance my portfolio. Due to the lack of activity in this category, I am rating this category with a “need improvement” rating.

2018 – Q1 Overall Performance

Overall, this quarter has been a terrible quarter from a net worth growth perspective. Anytime when my net worth decreases, I need to do better. On the other hand, I am fortunate that my personal net worth only decreased by a reasonable 2.62%.

Every year, my investment goal is to beat both the Candian’s S & P TSX Index and the U.S.’s S & P 500 index. Unfortunately, my current performance only exceeded the Candian’s S & P TSX Index and lags the U.S.’s S & P 500 index a little.

There is only one number that really matters to me – my personal net worth. Regardless of what happened in each of the categories, the bar is set at 10% net worth increase. If my net worth increased above this number, then I’ve exceeded my own expectation. Anything less than 10% is not meeting my expectation. At this rate, I have a lot of ground to make up the next three quarters. As a result, this quarter’s performance deserves a “need improvement” rating.

So readers, how often do you conduct your personal net worth calculation? What financial goals did you set for yourself in 2018? How do you balance your current lifestyle with saving for the future?

About Leo

About Leo

This is so interesting. I’ve actually never thought about any of this for myself! Thanks for laying it all out!

Planning and organizing is crucial when it comes to money, savings and business. A family and a household is just like a business in the end

Oh wow! I never really thought about it. I did make a review of my insurance payables because they are already wearing me out. But maybe, if I write down our net worth, I will be encouraged with what I will see. 😀

I can imagine it must have been a crazy quarter with everything going on, whether it be recession fears or trade wars, finances would take a hit. You still have a healthy balance sheet though.

I have never went this in depth with my own personal net worth. The only things I’ve really focused on was keeping our overall DTI Ratio between 30-40% and Itemizing as much as possible to save on taxes. I think I might want to go a little more in depth with mine now!😊

Nice leo. Great work with the options and puts. Clearly this year the market hasnt liked what has been happening. Most people are down a bit and if you have enough invested it will effect your net worth negatively. The good news though is when it pops back up your networth will jump up as well! Just keep throwing money into the market as im sure your doing!

Cheers

I had a down month too this month, down by 3K (last month was down but just by $60) and it’s hard to see but it’s expected. The market has got to come down sometime.

Thanks for sharing your detailed analysis and review of your income and net worth!

For your $500K in savings, is that in a high-interest savings account?

The market has been going up and down like a Yoyo. One day it’s up 500, and the next day it’s down 600 points. It’s been a wild ride so far in the first quarter and will most likely continue for the rest of 2018. Just like you, I’m currently on the sidelines with a little cash waiting for the opportunity. There were days when I don’t even look at my values. You’re doing good Leo, and you have clear financial strategies. You will reach your goal sooner than you think.

a comment for other folks following your blog.

I see your investment approach as high risk, its not negative comment, just that many folks would likely not go that route.

a quick take on the good debt of $672,976 to investment of $543,067, is there any reason or purpose of continuing carrying your risky negative investment debt of approx $130,000 the way that you do, or will you always be in the negative net investment position of borrowing/leverage to investment asset?

if you were to cash out the investments, pay off the good debt, where would get the $130,000 to cover?