Every year, right after the Christmas holiday, the fitness advertisements from health clubs, dietitians, exercise equipment manufacturers, weight loss products and exercise programs started to pour in. You’ll be bombarded by television commercials, radio ads, street billboards, ads on public transit, magazines, flyers delivered to your mailbox and even when you are surfing the internet, the Google AdSense ads will follow you to every site that you go to.

At this time of the year, the fitness industry knows that people have overindulged on a meal or two (I just can’t resist all those tasty foods during this time of the year when the mood is so festive.) In addition, with the new year just around the corner, most people want to set themselves up for a brand new year and will try to improve themselves mentally and physically by making new year resolutions. Though I don’t have any statistical data to prove it, I think that weight loss would be one of the top three new year resolutions for most of the people living in Western countries.

While physical fitness is important for our overall health and we should keep ourselves fit, financial fitness also plays a major role in our overall health too. In my opinion, being financially fit should also be one of the top three goals that most people should set for themselves in the new year. To get into tip-top financial shape, I’ve compiled a checklist to make it easier for you to stay in the financial gym way pass the mid-February mark and keep you motivated longer.

Check your credit reports/scores

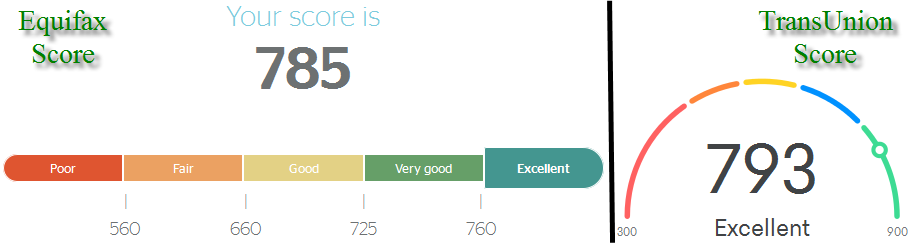

One of the most often used gauge to measure your financial health is your credit score. The two major companies that track your credit score and credit history are Equifax and TransUnion. You can go to both of these companies’ website and fill out a form to get your credit report for free once a year, but you’ll have to pay to get your credit score.

Over at Million Dollar Journey, Frugal Trader had a great post on how you can check your credit scores for free and I do recommend that you sign up with at least two sites to check your scores for free. One that’s provided by Equifax and the other provided by TransUnion.

I signed up with Credit Karma as it provides a credit score and report from TransUnion. To see my credit score from Equifax, I signed up with RateHub.ca. After signing up, the first thing that I did was to check my credit score of course. To my surprise (this is the first time that I check my credit score in years), my credit scores are 785 for Equifax and 793 for TransUnion. For me, the credit scores of both companies are quite close (you are probably not going to have the same score from both companies as they use a different formula to calculate it) so I was quite satisfied with it.

For many reasons, if there is a big difference, like 50+ point between the two scores, you should definitely investigate further. However, if your scores are similar and you want to improve it, you can once again visit Frugal Trader’s post on how you can improve your credit score. A good way to start is to always pay your bills on time and in full every month.

My Equifax and TransUnion credit score.

Create an emergency fund/plan

Life is unpredictable and sometimes at the most inopportune time, $hits happen and you will experience a setback or two in your life. To minimize the impact of these unforeseen events on your financial health, the best way to do it is to have an emergency fund or access to funds. Though it’s not a bulletproof plan, having a plan is better than no plan at all. Depending on what stage of life you are currently at and the personal assets that you own, you can view and build your emergency fund in different ways. This is a personal preference thing and the number is up to you as long as it allows you to sleep well at night without worries.

For me, I don’t need an emergency fund. I built access to emergency funds as my philosophy about the emergency fund is quite different from the finance experts out there. You can check out my post on how I built access to a $100,000 in emergency fund instead of having cash sitting in a savings account.

Develop a saving habit

When you exercise on a regular basis, chances are, you will be in decent physical shape. There is no guarantee that you’ll become a professional athlete, but for sure, you may be able to turn a few heads at the beach. The same is true if you have a good saving habit and save on the regular basis.

If you save even 5% of your income on every pay cheque, you’ll be in decent financial shape, just like having a 15-minutes walk on a daily basis. It may be hard to start at the beginning, but once you get into a routine, it’ll be second nature to you. For example, I have at least 6% of my income deducted from every pay cheque and direct it to my Registered Retirement Savings Plan (RRSP) account for more than 10 years now.

Over the years, I can honestly say that I had never noticed any negative impact on my financial health or cash flow. In fact, my saving habit had improved my financial health significantly over the years and it’s one of the major factors that helped me built a healthy net worth of over a million dollars over a 10 year period. If you need some motivation to save, you can read my post about how I earned a 72% return on my savings the easy way from a while ago.

Create a budget

To be honest, I’ve tried creating a budget before, but I’ve never finished creating or having a fully working budget. It’s not that I can’t do budgeting or I don’t want to follow a budget. I’ve always been very money conscious ever since I was very young and I am naturally good with numbers and often like to do (simple) arithmetic in my head (fun fact, I once wrote a high school accounting final exam without a calculator and passed it). Hence, I have a very good idea of the inflow and outflow of money from my accounts. However, with that being said, I still think that a budget can be very useful in several ways.

The most obvious is that you have an actual record of the monthly expenses tracked and you can see how much you are spending on a monthly basis versus how much income you are making. Numbers don’t lie, people do. This is a great way to make yourself accountable for your own financial success or failure. Secondly, a budget can help you identify which area of your monthly expenses that you can work on to improve your finances and reigning in those frivolous expenses. Third, most of the great budgeters have savings built into their monthly budgets to ensure that their incomes, expenses, and savings are fully integrated as one.

If you are looking for resources to help you learn how to build your budget, check out Kristal Yee’s and Canadian Budget Binder’s blogs. These two are master budgeters and I have learned a lot from reading their blogs.

Set financial goals for yourself

When you exercise on a regular basis, if there is no fitness goal like being able to bench press your own weight, or running the half marathon in 3 hours or reduce your body fat to 10%, you tend to plateau after a while and even losing your motivation to exercise overall. This is usually the case for a lot of people who joined the gym at the beginning of the year and by mid-February or so, they quit. The same goes for your savings habits.

If you don’t have a concrete financial goal to drive you, you’ll eventually lose your discipline and motivation to save because you don’t know how much money you’ll need at retirement and when you can retire. I almost fell into this trap until I started blogging. I am really happy to share with you that by knowing how much much I need at retirement and when I can retire have motivated and inspired me to be financially fit more than any point in my life. I called this motivation factor my Freedom 48, the age that I am striving to retire by.

Stay tuned. In Part 2: How To Improve Your Financial Health, I’ll be covering the topics below. Until then, have a happy and safe holiday. Happy New Year and see y’all in 2017. I mean don’t forget to come back and read the second part of my post in 2017.

Part 2: How To Improve Your Financial Health

– Debt management

– Have a workout buddy

– Join a financial fitness class

– Understanding the basic tax rules

– Setting your own reward system

– Financial fitness assessment

About Leo

About Leo

Hi,

I’ve over indulged in food and spending over this holidays like you mentioned. It’ll be great if you can share your budgeting tool or template.

Hi Cynthia,

Thanks for dropping by and sharing your holiday activity with us. As I’ve mentioned in my post, I am not that great at budgeting, but I can refer you to two great budgeters that I know. You can either follow their budget system of download their budget template. Happy holiday.

Check out Krystal Yee’s blog or Canadian Budget Binder’s blog, they are master budgeters and they do have budget templates that you can use.

– Leo

I think you are absolutely correct. Too often we focus on the external appearance during this time of year and not enough on your financial appearance. This is the perfect time to do a financial check up and ensure that we are doing everything that we need to and haven’t gotten fat and lazy with our finances which may be a drag on us in the future. Great timely post!!! Thanks for sharing.

Thanks for dropping by and sharing your thoughts on the post MSM. Greatly appreciated.

The reason that I wrote this post is to get people thinking about their finances and it’s a great time to take action to improve and put themselves in a better spot. Especially when it comes to investments and savings. If people start investing at the start of the year instead of the end of the year, they’ll reap the benefit of one extra year to compound their money.

Finally, the free credit score offer coming to Canada. However, I am not sure that I will be comfortable providing my personal info to a third party if I don’t read use their product.

On the fitness front, I can definitely lose a couple of pounds. Maybe make less trips to restaurants and more trips to the gym will help.

For sure, you can trim your waist line, but you’ll keep your fat wallet. That’s one place where I don’t mind to have a little bit of fat.

Every year I have physical fitness goals that I set for myself, but I often neglect to pay attention to my financial goals. Thanks for bring this up. Since it’s the beginning of the year, I guess it wouldn’t hurt to set a couple of financial goals on top of my physical goals.

The beginning of the year is a great time to set goals for yourself. I am glad that this post is motivating you to set new goals. I’d love to know more about it if you are willing to share.

Hi my name is Natalie Murray and I just wanted to send you a quick message here instead of calling you. I discovered your Part 1: How To Improve Your Financial Health – I Saved $5K page and noticed you could have a lot more traffic. I have found that the key to running a successful website is making sure the visitors you are getting are interested in your subject matter. There is a company that you can get keyword targeted traffic from and they let you try their service for free for 7 days. I managed to get over 300 targeted visitors to day to my website. http://s.t0m-s.be/5q

Thank you for the message. I sure can use some extra traffic. I will checkout your website to see if there is any service that can benefit me.

Did you just create your new Facebook page? Do you want your page to look a little more “established”? I found a service that can help you with that. They can send organic and 100% real likes and followers to your social pages and you can try before you buy with their free trial. Their service is completely safe and they send all likes to your page naturally and over time so nobody will suspect that you bought them. Try their service for free here: http://korturl.no/1pwo8

Hi Jennifer,

Thank you for the heads up. I can definitely use a few more likes on my Isaved5K facebook page and will definitely check our your service.

Hello my name is Natalie Murray and I just wanted to send you a quick message here instead of calling you. I discovered your Part 1: How To Improve Your Financial Health – I Saved $5K website and noticed you could have a lot more traffic. I have found that the key to running a popular website is making sure the visitors you are getting are interested in your subject matter. There is a company that you can get keyword targeted traffic from and they let you try the service for free for 7 days. I managed to get over 300 targeted visitors to day to my site. http://thrivemarket.ru/ja

Just wanted to point out that I recently found a new personal finance app (for PC) named Geltbox Money (www.geltbox.com) that eliminates the need for third party aggregation services.

Geltbox is a personal financial aggregator designed for homes and small businesses. Geltbox gives you a clear overview of your expenses, investments, loans and assets. It aims to help you plan your monthly savings and your investments. The ultimate goal is to help you reach financial security.

Thanks for the suggestion Jessica. I can definitely use some organization in my finances. I will definitely check it out.

This is a memo to the website creator. I discovered your Part 1: How To Improve Your Financial Health – I Saved $5K page by searching on Google but it was difficult to find as you were not on the first page of search results. I know you could have more visitors to your site. I have found a site which offers to dramatically increase your website rankings and traffic to your site: http://maar.ch/7wb0f} I managed to get close to 500 visitors/day using their service, you can also get a lot more targeted traffic from Google than you have now. Their services brought significantly more traffic to my site. I hope this helps!

Thanks for the advice and feedback Sharon. I will consider the offer as I can definitely use more traffic to my site.

I must say you have very interesting content here.

Your page can go viral. You need initial boost only.

How to get it? Search for; Etorofer’s strategies

Thanks for the recommendation 97Minda. I’ll definite check it out as I am still new with online marketing and promotions. I am not sure about this article going viral, but if it gets people thinking about their finances, I’ll be quite happy with that result.

Hi Leo , my husband and I are low income , being on disability we rarely have anything left at the end of the month .My New Year Resolution is not to loose weight rather to save regulary , even just a tiny bit . As my dad used to say “Tall oaks from little acorns grow …..Id like to keep an eye on your blog just for tips really .Do you have any related to low income specifically ?

Hi Sheila,

For now, I have not written that many posts that with low income in mind (I will definitely write a few in the future). However, I once came from a low income immigrant family and I can definitely relate to your situation. My advice is to start slow and not get into high interest credit card debts and pay day loans. Secondly, try to increase your income if possible. There are things that you can do online like processing emails or fill out surveys that can provide you with extra income. Of course, entering free giveaway can also help too. Good luck on the draw.

I made a conscious decision to downsize this year… we are a family of five living in a fairly small house. All of our 3 kids are in university at the same time and we are drowning in stuff. We are all determined to rid our house of stuff… eating up packaged foods one day at a time to use up some of the excess, donating or re-homing an item a day and keeping track of the things i do to save money all keep me motivated. Painting and repairing our home to freshen it up and maintain our largest investment… repairing instead of replacing where possible… and your blog fits right into my mindset.

I think the one thing new this year is I set some easy to track GOALS. Not just “Save money” but “save $1000 during each month”. and not just get rid of stuff, but instead physically take one thing off the shelf and use it or take it to the basement donate box. This year is gonna be different for us! I’m so happy I stumbled across your blog. Keep up the good work.

We are really having to monitor our spending verus income. I won’t bore you will the events that brought this about but with this in mind, I have set up a tracking spreadsheet and log all our expenditures, no matter how small. It is a great tool to see where our money goes and how to improve our money flow. Thanks for the article, I found interesting and helpful points within it.

Tracking your expenses versus your income is a great way to be accountable for your own finances. I also use the Excel spreadsheet to track my net worth and it gives me great joy to see my money growing from one quarter to the next.

Very nice tips that you have present here. keep progressing and let us know good points.