The first two of my personal finance series posts covered the basic and everyday personal finance concepts. They were meant to get readers to start thinking about and changing their money habits. By mastering those money concepts, they will have built a solid foundation and discipline to save their money. The next step is to learn and master the basic investment concepts to grow their money.

Investment Involves Risk

The first thing to know about investment is that every investment (stocks, bonds, real estate, etc.) comes with a certain amount of risks. There is no such thing as a risk-free investment. If you want to make a return on your investment, then you need to take some risks. Of course, the correlation between risk and potential return on investment is that the higher the investment risk, the higher the potential for better returns.

When people think about investment risks, they usually think about the loss of values in their investments. Keep in mind that the market quote of any investments on a daily basis is just the price that someone is willing to buy or sell at any one point in time. If you are not selling your investments, then the price on the investment is just a quote. Nothing more and nothing less.

Another misconception is that people think that investing in the stock market is very risky. If you are betting all your money on one stock, then it’s risky. You can lose all your money if the company goes bankrupt. However, if you spread your money into a few baskets of market indices and invest for the long-term, your chances making money are pretty good.

Here are some interesting statistics based on A Wealth Of Common Sense’s post on the probability of making money if you invest in the S&P 500 index. If you invest in the S&P 500 index, your chances of making money is 86% over any 5 year continuous investment period. Your chance increases to 94% over any 10 year continuous investment period. And finally (drum roll please), your chance increases to 100%, that’s right, 100% over any 20 year continuous investment period. So, how risky is it if you have a 100% chance of making money?

Source: CNBC

Understanding Historical Returns

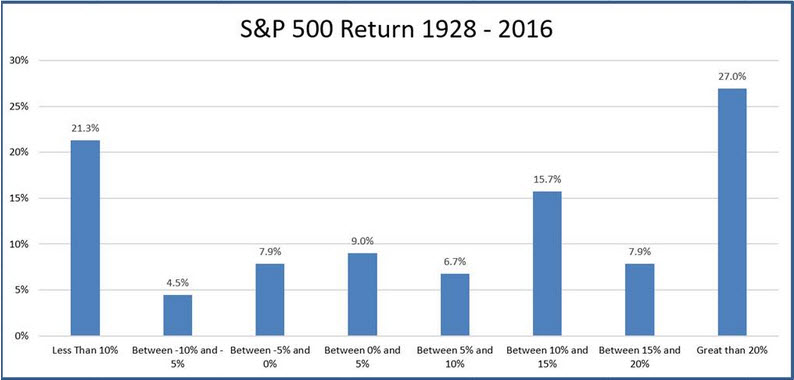

When investing in a single stock, the historical return may not necessarily be a great predictor of future performance. However, for market indices, we can use the average annual return as a guide for future expected returns. So what does the data tell us and what can we expect in general when we invest in a market index like the S&P 500? Let’s dig a little deeper.

Based on a recent article at CNBC, over the last 89 years (see the graph above), investors made money about 75% of the time on an annual basis if they invested in the S&P 500 index. To make it simple, if you invest for four years, chances are you’ll make money in three of the four years. In addition, the average annualized return for the S&P 500 index over the past 90 years is 9.8%.

Another statistics that I found interesting was the return from 3-month Treasury Bills and 10-year Treasury Bonds. These are considered some of the safest fixed income investments as they are backed by Uncle Sam. Based on data collected by professor Aswath Damodaran at New York University, there were years that you could lose money if you had invested in the 10-year Treasury Bonds.

How can you lose money if the bonds were guaranteed by the U.S. government? The first reason is that the bonds were traded on the open market. Hence, the value goes up and down based on what price people were willing to buy or sell. Secondly, the value of the bond was affected by interest rates as it had an inverse relationship with interest rates in general. If interest rates go up, bond prices go down and vice versa. You will not lose any money if you’ve bought the bond at face value and hold it until maturity.

Diversify Your Investments

You may have heard of the cliche, “don’t put all your eggs in the same basket.” There is a reason for not putting all your money in a single bond, stock, real estate or your own company. Yes, there are cases where people had made a fortune by having their investment concentrated in one area. The same can also be said about people losing a fortune for investing in one area. Hence, it’s always prudence to spread your money out because you want to minimize the risk of one bad investment that can wipe out years of your savings.

Asset allocation

So how do you diversify your investment? You can do that by asset allocation, which means you spread your money out in different types of investments. For example, you can divide your money into a few buckets like cash, bonds, stocks, real estate, etc.. Cash is for your short-term needs or taking advantage of investment opportunities. Bonds are for regular income streams, safety in investment principal and the low volatility. Stocks are for long-term growth and preferential tax treatment of incomes. Lastly, real estate is an investment in your life as you need a place to live.

Understand Investment Liquidity

When you invest, one thing to really pay close attention to is the liquidity of an investment. This just means how quickly you can convert that investment into cash. Sometimes an investment with great potential can turn out to be a bad investment if you have a liquidity issue. For example, you can buy some bonds that pay you a 5% in interest annually, it has a 10-year maturity date. The interest rate is great, but if you need the money in about five years, then you may have to sell at an inopportune time and lose money.

To minimize your investment liquidity risk, you need to plan your cash flow according to your financial needs. For the money that you need to use in the short-term like less than two years, it’s best to keep these investments liquid. For medium terms like two to five years, you can be a bit more flexible and have some money locked up to make a better returns. As for long-term investments, these should be your retirement money where you don’t need it until you are retired. So it can be invested in less liquid investments with a longer holder period.

Understand The Economic Cycle

Regardless of where you live in the world, the economy will experience periods of growth and recession. This is called the economic cycle. During periods of growth, the price of assets such as stocks and real estate usually goes up. They also usually go down in times of recession. The important thing to remember is that it’s a cycle and you don’t need to panic if the value of your investment goes down. It’s best to seek advice from your trusted advisor before you press the panic button and sell during a down cycle.

Minimize Investment Fees

When you invest, it’s important to pay attention to the rate of return for your investments. It’s even more important to pay attention to the fees you pay on those investments. When you start to invest with a small amount of money, a 1% extra in investment fee may not seem like much. However, over a period of 20 years or so, or when your investment value reaches the six figure mark, an additional 1% in investment fees can potentially cost you thousands of dollars. It’s best to know the amount of fees that you are paying and try to minimize it as much as possible.

Set Your Investment Goals

You can’t get to your destination if you don’t know where you’re going. This is also true for your investment. You won’t be able to achieve your financial goals if you don’t know what they are. It’s best to come up with a plan on how to achieve your financial goals step by step. A good place to start is to set a goal on how much money you want to save each month. How and what you will be investing in. With the amount of contribution that you are making each month and the potential rate of return on the selected investment, is your financial target achievable?

The importance of setting your financial goals is to first get you started and build momentum for the long-term. It’s best to take it one baby step at a time. Know that results will not be there overnight and your money takes time to grow. Be realistic with your goals and investment return expectations. You will most likely not be able to accumulate a million dollars in ten years if you are only $100 per month and your money is invested in bonds.

Use A Passive Strategy

Once you have settled down on an investment strategy, it’s best to leave it on autopilot and let time and compounding do the heavy lifting for you. From time to time, reviewing your investment and making adjustments based on your family situation. Reviewing your investments once a year is sufficient. The less active you are, you’ll save money on trading expenses and ignore the volatility of the market’s day to day movements.

Use Logic Instead Emotion

A great example of using logic to invest rather than emotion was during the great recession in late the 2008 and early 2009. During that time, many banks were in trouble in the U.S. because of the subprime housing market and the Canadian banks were painted with the same brush as the American banks. Investors were selling Canadian bank stocks indiscriminately along with U.S. bank stocks.

If those investors were using logic to invest, they would have discovered that the Canadian lending practice was a lot more stringent than their U.S. counter part. At the same time, the Canadian banks’ leverage ratio was a lot lower than the American banks. Hence, just because there are issues occurring in a sector of the economy doesn’t mean that all companies in that sector are the same. Successful investors will be able to use logic to make their decisions rather than using their emotion.

Invest In What You Know

Many novice investors lose their money because they were investing in an investment that they don’t have a lot of knowledge in. For example, back in the dot com bubble in the early 2000s. Many tech companies had market values that were worth billions of dollars, yet they made no money at all. Investors were pouring money into these companies because they were following the momentum of these tech stocks and seen other investors double their money within a matter of months.

Of course, everyone knows how the story of the dot com bubble ended. Many investors lost their money because they invested heavily in the tech sector. It was a hot sector to invest in and they don’t want to miss the boat. The lesson is to know why and what you are investing in. Just because other people are making money on that investment, it doesn’t mean that you should be investing in them too if you don’t understand what you are investing in.

Turn Fear Into Opportunity

One of my favourite quote from Warren Buffett is, “be fearful when people are greedy and be greedy when people are fearful.” In simple terms, he’s telling us to buy when people think that the sky is falling. Why? Because we want to buy low and sell high. The time that you can buy low is when people think the sky is falling. Hence, use other people’s fear and turn it into an investment opportunity for you to invest.

My Two Cents

To become a successful investor, one does not need a finance degree or hold a Certified Financial Analyst (CFA) designation. The important thing to remember is to invest in what know you know, diversify your investments, use logic rather than emotion to invest and to contribute money to your investment account consistently over time. The best investment that you can make is an investment to enhance your financial knowledge and the mastery of basic investment concepts.

So, have I missed any concepts that can help novice investors enhance their investment knowledge? Do you have any investment plan to grow your savings? Is investing for your future a high priority?

About Leo

About Leo

I’d add – buy and hold for the long term.

The S&P 500 in any single year has lost more than 50% and gained more than 50%. Short term investing can be a gamble.

When you look at every past 16 year stretch, the S&P 500 has not lost money. It’s been right around flat a couple times though.

Looking at 30 years… the range is something like +4% to +15% — no 30 year stretch where there has been a loss.

Many people don’t understand this and they freak out over short term market moves, panic sell, and lose money. With a well-constructed diversified portfolio time is on the investors’ side.

@Brad, Buy and hold is definitely the key to any investor’s success. All investments need time to grow.

When you invest, it’s best to not panic when the market is pulling back. When you understand the market behaviours, it makes investing in the stock market easier.

@Leo, in most all of the above. Good post

Your comment “invest in what you know”. I should add ‘invest in what you understand & that if you don’t understand [get] it 100%, then don’t go there’ the risk is too high even a 5% loss

As you pointed out – it’s easy to invest in something & lose or know when to sell. It’s the ‘investing to always win’ makes a smart person.

To know that the broke, hedge fund manager or someone that makes pennies out of your investment always wins, whether you win or lose.

@John, to avoid investing in what you don’t know, investors should always do their homework first. What may sound like a safe investment for one person, may not be safe for another. So know yourself and what your needs are to ensure that you are investing in the investments that are right for you.

What a fantastic article Leo, your writing has continued to improve over the last few months and it’s showing!

I’m trying to figure out where to best put my money to use. I have my 401k and IRA, but also want to continue to diversify into real estate and other income producing activities.

@Erik, thanks for the complement (I am blushing already). Your encouragement means a lot to me as English writing was not my strongest subject in school.

Diversifying your money into different assets is definitely a great idea. One of the reasons that I continue to refinance my mortgage and take the equity out of my principal home is that I don’t want to have too much of my net worth invested in just one asset.

Nice Leo investing for the future should be everyones priority. Unforetuantely at the moment it isnt. Great post and nice chart!

@PassiveCanadianIncome, I find that as I age, my priority changes. With the goal of achieving financial independence by the age of 48, investing in the future is definitely a high priority for me.

Sometimes I feel like people skip this step and try to go onto more complex investing principles. I think if people bought the S&P 500 with a buy and hold strategy that 90% of people would be better off 🙂

Love that you started with the involvment of risk…cause no risk, no reward – right?

Very nice guide to investment concepts, I find most people have no idea and just leave their money in a savings account that has super low yields.

Thank you for the great tips. I have always been intimidated by the stock market.

That’s just an informative article. Earlier I never thought about making investments but with the time this always seemed like something I should do

So important! I always try and be careful with my money. I haven’t tried to make investments yet.

So much of this information is way over my head, to be honest. But I do know there is no investment without risk but also no gain without risk.

Fantastic article for understanding basic investment concepts. I’d love it if you’d share investment advice for those who are getting close to retirement. That would be so helpful too. 🙂

I am not what you would call good with money but I really like the sound of diversifying your investments so you are not relying on one source of investment to tide you over. After all it can be difficult to estimate how the stock market will change!

This is a good informative article… I am not that good with money or investing it… The worst part is I have no idea about anythings until I read this article… Thanks for sharing 🙂

Intrigued by diversifying investments. Bookmarking this to read again, and I actually will.

I really love this article. This stuff feels so beyond me sometimes, but you went in to great detail. This is going to help a lot of people.

I remember someone said this to me in the past that in terms of business never be afraid to take a risk because you’ll always be engaged with challenges that need taking risks. These are some awesome information about basic investment concepts though.

There is some great info in this article. I am not great with the terms and info when it comes to investments. Thanks for the tips.

I agree, investing to what you know is a wise decision. Also being creative on diversifying your income sources.

I think these types of posts really help people who struggle with understanding finance as a concept Leo, I appreciate the hard work you’ve put in this. I’ve come across individuals who are great with trading, investing and such but struggle to get their head around terms.