In last week’s post, I revealed that I paid less income taxes than my spouse even though my income was higher. I felt that I had skimmed through the income tax deductions checklist a little. Since it’s tax season right now, it doesn’t hurt to compose a thorough income tax deductions checklist to help us keep more of our hard-earned money. For the 2017 tax year, if you’re looking for a quick way to save some money, this is the post to help you find it.

The Registered Retirement Savings Plan (RRSP) Deduction

Let’s start with the usual suspect, shall we? The RRSP contribution deduction is one of the most efficient vehicles to lower your income taxes. Every dollar that you contribute to your RRSP account, you get to lower your taxable income at the highest tax bracket. For example, my top tax bracket is 43%, so every dollar that I contribute to my RRSP, I get 43 cents back as a tax refund.

If I have enough contribution room to lower my taxable income to the next lower tax bracket, I will get 43 cents back from part of the deduction and some at the next lower tax bracket. If you haven’t opened an RRSP account yet, now is the time to open one and start saving for your future. Regardless of your age. I lied. You can’t contribute to your RRSP after you reach 71 years of age.

The Public Transit Deduction

To claim this tax deduction, you have to have taken public transit at least 30 trips within a month during any of the first six months of 2017. Why only six months and not the whole year? The Federal Government decided to scrap the public transit tax deduction after July 1st, 2017. Hence, we can only claim this deduction for the first six months. For complete details check the government of Canada website.

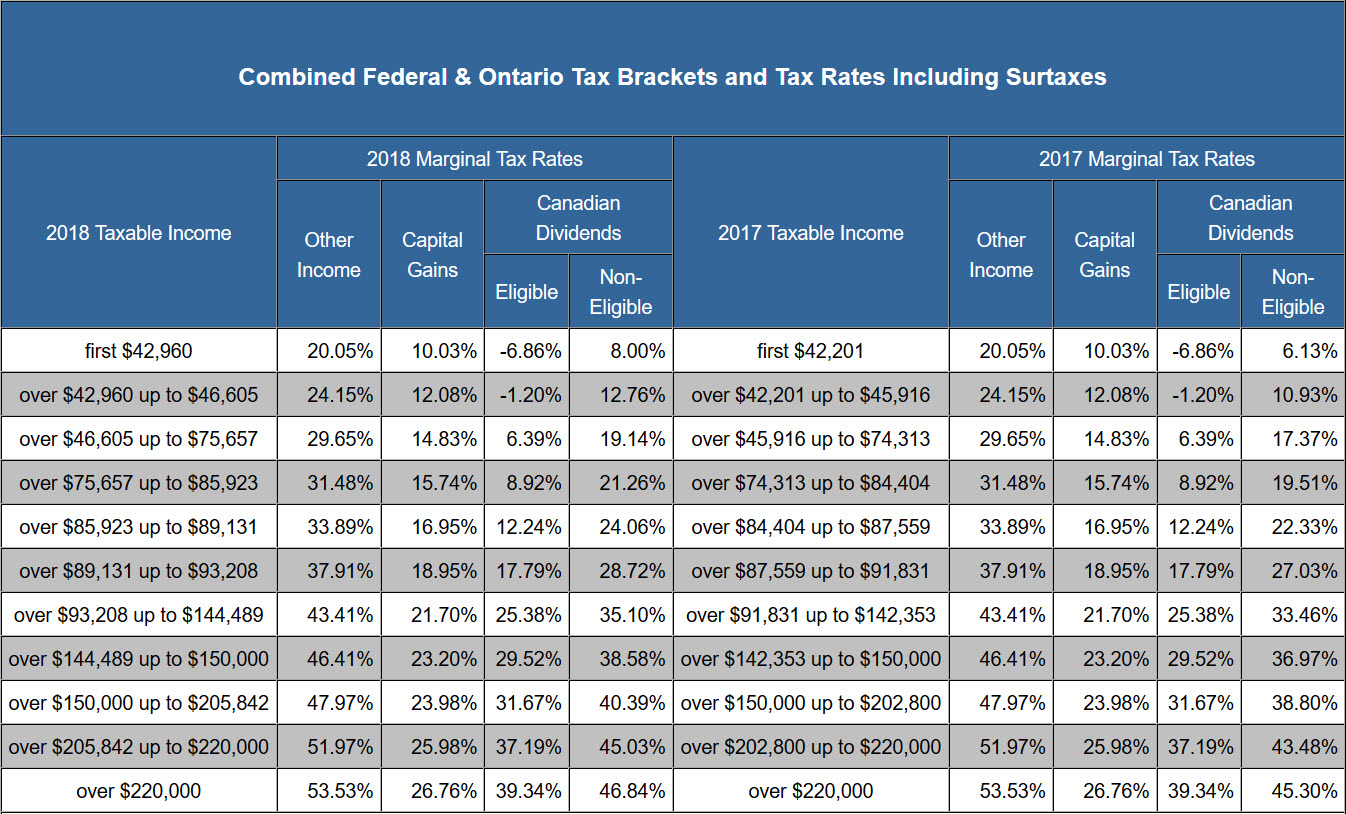

Source: Taxtips.ca – Ontario’s Marginal Income Tax Rate Table

The Canadian Dividend Tax Credit

If you own a Canadian stock that pays dividend, then most likely, you’ll qualify for the Canadian dividend tax credit. The reason that you’re getting this tax credit is that the company that you owned already paid the corporate tax. Now you’re being taxed on the dividend income paid to you by those companies.

It’s not fair that you’re being double taxed. Hence, you get a dividend tax credit to offset the double taxation. If you look at the tax table above, the lower your income is, the more tax-efficient the dividend income is. You’ll get a T5 slip from your investment brokerage if you received Canadian eligible dividend.

The Foreign Dividend Tax Credit

This tax credit is very similar to the Canadian dividend tax credit except it’s for non-Canadian eligible dividends. You will only get this tax credit if the company that you owned is domicile in a country that has a tax treaty with Canada. One of those countries is our neighbour to the south, the United States of America. You’ll get a T5 slip from your investment brokerage if you received a foreign dividend.

The Childcare Expenses Deduction

For most parents, to earn an income, they need to send their kids to a daycare or camp in order to earn an income. If you are a single parent, then you get to claim the total cost of your child’s daycare. However, if you have a spouse, only the lower-earning spouse get to claim the childcare cost. I wish that the higher earner can claim it, but that’s not the tax rule.

The Disability Tax Credit (DTC)

For parents with a child that has a mental or physical disability, they can apply for the disability tax credit. To qualify, the child must meet the disability definition set by the government of Canada and the child have to live with them.

Before a parent can apply for the disability tax credit, they must fill out the T2201 DTC certificate and register with the Canada Revenue Agency (CRA). Once approved, parents can request their income tax for prior years to be adjusted. You can request the CRA to adjust your prior years’ income tax return for up to ten previous years. Individuals can also apply for the DTC too if they are supporting themselves.

The Charitable Donation Tax Credit

If you have donated $20 or more to any Canadian registered charity and has a receipt, you can claim the charitable donation tax credit. If you are a first time donor and donated a substantial amount of money, then you may qualify for the first-time donor super credit. So don’t forget to ask for a tax receipt the next time you make a charitable donation.

The Vehicle Expenses Deduction

Have you ever wondered how some people can afford their expensive vehicles? Well, the trick is to make your vehicle a required part of your business. For example, if you are a salesperson and require to travel to meet your client at their location, you can claim your vehicle expenses as part of your business expenses.

If you use your vehicle only 50% of the time for your business, then you get to deduct 50% of your vehicle-related expenses. On the other hand, if you use your vehicle for business 100% of the time, then you get to deduct 100% of the vehicle expenses. Here is a list of the most common vehicle-related expenses that you can deduct.

The Business Expenses Deduction

If you are a proprietor or in a partnership business, you get to deduct business expenses in addition to your home office and vehicle expenses. Using myself as an example, for my real estate business, I require the use of a cell phone, Internet, computer, printer to conduct my business. Hence, the portion of expenses that are related to my business, I get to deduct them from my business income.

I also get to claim a portion of my meal expenses when I take a client out for business purposes. If you are in the Greater Toronto Area (GTA) and you want a free lunch and interest to talk about real estate, give me a shout.

The Home Office Expenses Deduction

I use about 10% of my home’s space for my real estate business. Hence, I get to claim about 10% of all my home-related expenses to reduce my business income. This type of usage for the extra space in my house is a lot more efficient than renting it out. There are three major benefits for this deduction.

The first benefit is that my business is paying for part of my home’s expenses. The second benefit is I don’t earn rental income and pay additional income tax when I use it as part of my business. Third, my business income is being reduced, so I actually pay less income taxes. Here is a list of eligible home office expenses.

The Investment Loan Expenses Deduction

This is one of my favourite deductions to claim because every dollar that I paid in investment loan expenses, it’s tax deductible. Most people think that when you borrow to invest, the interest expenses that you paid are sunk costs. In a way, it’s true. However, those people did not see the whole picture.

When you borrow to invest, you do receive some income like stock dividends or rental incomes. At the end of the year, you get a portion of the interest expenses back in the form of a tax refund. For me, I get 43 cents back for every dollar that I paid in investment loan interest expenses. This means that my actual investment loan only cost me 57 cents in total.

Do you know how I was able to save more than $100K last year? I used my income to pay for the interest expenses and forced myself to budget for this expense as part of my spending. In the end, these interest expenses turned into savings. For more detail of this maneuver, check out my post on how I saved $200K by increasing my debts.

Other Tax Deductions

Based on the list above, I was able to use all of these deductions except for the childcare deduction to lower my income taxes. That was how I got about $17K of tax refund for the 2017 income tax year. To help you find more deductions, below is a list of other deductions to checkout to see if you qualify for it.

My Two Cents

It doesn’t really matter if you are filing your own taxes or hire an accountant, it’s best to have basic knowledge of the tax rules. It’s even better if you know what deductions you qualify for so you can ensure that you are not paying more income taxes than you should. Ultimately, it’s not how much you earned, but it’s how much you get to keep after taxes. Now, go and get your refunds.

So readers, did I missed any common tax deduction that may be helpful to this community? Did you get a refund or you have to pay more income taxes? Do you do any tax planning throughout the year?

About Leo

About Leo

One thing I have mentioned last week is the use of the “Request to Reduce Tax Deductions at Source”, form T1213.

If you have regular expenses, like charitable donations, medical expenses, child care expenses (3 very common ones; there are many more), you can have the CRA reduce your taxes at the source by submitting this form. Then you can take the extra tax savings and either pay down debt or invest for more compounded returns.

This will reduce your taxes throughout the year, so your tax refund will be smaller.

Tip: It can take 8-10 weeks to get your reply, so file it around early Oct so that you get your approval in time to submit to your employer to apply the reduction by your first pay check in the new year.

Wow great list and breakdowns Leo!

Absolutely fantastic tax return. Keep it up.

Cheerz

@PassiveCanadianIncome, The more you learn, the more you’ll

earnkeep in your pocket is much more appropriate :). Since we already earn the money, we want to keep more of it :).What a useful post with some really great advise and tips. I am sre those who are doing a tax return will definitely gain some useful help from this post.

This just reminds me how close the end of tax year is, I need to sort out all my expenses ready to file next month x

I’m becoming an adult and this could be really helpful. I’m sure going to use in this in real life and help me understand all of this terms 🙂

I hope this is applicable in my country. These are really great tips! I really learn a lot from you!

To be honest I am so glad that I live in the UK as our taxes is done for us and taken from our pay.

I’m hoping this is applicable in my country too! Great tips and advice you have there. Thank you for sharing this information 🙂

I just envy that Canadians have so many exemptions. It’s really hard to believe!! I hope someday we in India will also have such features. Wonderful info. Thanks for sharing and I will definitely share it with my mates. Keep us posted.

@Rajesh, every country’s tax code is different. I am sure that I you dig hard enough, you’ll be able to find a deduction or two to help your situation. Once you’ve found it, use it to your advantage to keep more money in your pocket. 🙂